top of page

Basic Loan Terms

The FTHB Program offers a 30-year loan with a fixed 3% simple interest rate. The loan is deferred with no monthly payments due during the loan term. At the end of the 30 years, the entire loan (including both principal and accrued interest) is forgiven. There shall be no payments due on the principal or interest owed so long as no Sale or Transfer of the property or Event of Default has occurred. If the loan is paid off early, due to a sale, transfer, or a refinance prior to the 30-year loan term, the principal and the greater of accrued interest or share of the property’s increased value is due.

If the property has appreciated from the date of purchase to the date of repayment, the City will evaluate whether the principal along with accrued interest will be due or whether the principal plus a share of appreciation in direct proportion of the dollars loaned at the time of purchase will be due.

If the property has depreciated and is worth less than when the property was purchased, the amount owed (both principal and accrued interest) is reduced by a portion of the decrease in value, based on how much the loan contributed to the original purchase price.

If the FTHB Loan is utilized to purchase a Below Market Rate (BMR) home, repayment of the loan prior to the 30-year term shall include the repayment of the FTHB Loan principal and accrued interest only. The repayment calculation does not include a share of appreciation due to the affordable resale restriction that supports the long-term affordability of the home for future buyers.

The Loan Amount

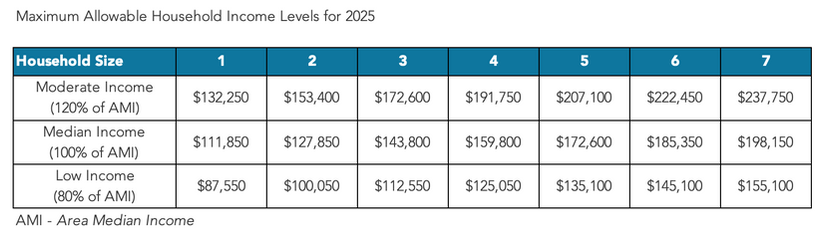

The FTHB Program includes a tiered assistance system based on Area Median Income (AMI) levels and size of the unit by bedroom count to determine the maximum loan amount. The amount the Applicant may receive will vary depending on each Applicant’s individual circumstances, however the maximum FTHB loan an Applicant can receive is based on the following:

-

The loan amount for a studio and one-bedroom is capped at $100,000 to support homeowners earning 120% AMI or below.

-

The loan amount for a unit with two or more bedrooms, is capped at $150,000 to support homeowners earning 120% of AMI or below.

The individual has owned property that did not comply with state or local building codes and cannot be brought into compliance for less than the cost of constructing a permanent structure.

-

The loan amount for households at 80% AMI or below is capped at $200,000, regardless of the number of bedrooms.

bottom of page